What is the difference between the flag ceremony on 15th Aug and 26th Jan? - An interesting fact

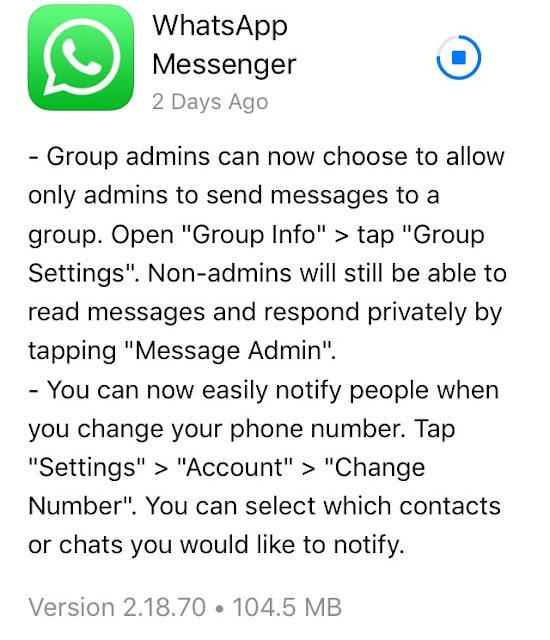

What is the difference between the flag ceremony on 15th Aug and 26th Jan? An interesting fact I learnt today: On 15th Aug the flag is Hoisted (from below) and unfurled. Reflecting the very first day in 1947 when it was done so for the first time. On 26th Jan, the flag is already up there and is unfurled. Independence Day: National flag is hoisted by political head of India, the Prime Minister at historical site Red Fort in Delhi. President does not hoist national flag on Independence day as he is a constitutional head and there was no constitution and President in India till 1950. Republic Day: The Constitution of India came into force on 26th January 1950. Where we had the constitutional head of India, the President from this time. Hence on every 26th January, constitutional head of India, the President unfurls national flag at Rajpath in New Delhi. Courtesy: Whatsapp Message